|

O2C, RPA ... sounds like a StarWars robot right? Well, they are not so far far away for your galaxy!

The order-to-cash (O2C) is one of those company processes that can either make or break your business. How you manage it has a direct impact on customer satisfaction, cash flow, and employee´s happiness.

On the other hand, it is not a simple as many people think. The breadth of the O2C process makes it one of the hardest processes to track and optimize....! What means it´s a big opportunity for improvements!

let´s roll with the basis:

What is an order-to-cash?

The purpose is clear: to deliver goods/services ordered to a customer in exchange for cash. Typical example:

Order creation - Fulfillment - Shipping - Invoicing - Payment

Simple? well, reality is never this straightforward! Think of extra steps (like goods issue, delivery, clearing, cash a check. There are millions of transactions that cross departments making really difficult to get an overview of the process, so ...lets try to simplify it: O2C consists of two main parts: Order management and Cash receivable , with slightly different goals each (the goals of order management might be improving the order rate, on time shipping or order fulfillment cycle time... while the goals of accounts receivable include reducing overdue payments and DSO days sales outstanding )

Challenges

In the O2C process, these two sides rely heavily on each other. Order management can’t achieve true efficiency without the support of accounts receivable and vice versa. However, the teams driving these two parts of the process sometimes end up working in silos which does not lend itself to an efficient process.

Sure, you have thought on other common challenges in the O2C like:

So, how can we improve such a complex process like O2C? Well, it is perfect for using process mining to find automation potential.

Process mining

Process mining connects directly to the systems that interface with the O2C process, such as Oracle, or SAP and other ERP systems. Using an in-built data transformation layer, the technology transforms data into a process graph that chronicles the entire process from start to finish. It captures all process variations, bottlenecks, rework , and exceptions.

With process mining, you can see exactly what happened in the process, figure out why it happened, and work on a plan of action to improve it.

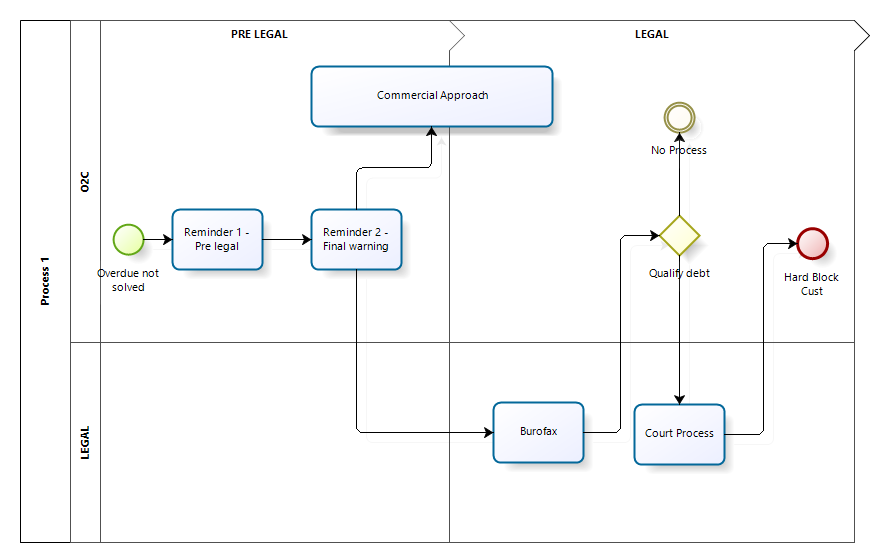

(A manual approach like the picture below it gives you an overview that it might be enough for quick gains)

Automate as possible

Process mining will tell you undiscovered automation potential in your processes. The quickest way to automate is using RPA (Robotic process automation) for those small iterative tasks that delay the whole system. You might have discovered for instance that certain customer requires a confirmation of delivery slip and that its a manual work donde at collections moment. using RPA the slip will be sent automatically to the define email just in time for payment.

Control and Iterate.

Once you have done a few steps with RPA, use process mining again to track results and ensure that automation is reaching the expected goal.

Conclusion

There is always room for improvement in any business process and O2C is a key chain that deserves your continuous attention.

Do you feel process mining or RPA are too complex for you? or maybe there are intended only for those big companies? ....,think twice and get in touch with an expert to review your process. You will be surprised!

Via https://empresologo.postach.io/post/o2c-and-rpa-a-path-of-discovery

Aguas cristalinas, una playa en el horizonte, el viento ondeando las velas, el agua salada golpeando la quilla,... idilico eh?

En el oceano de los negocios, las cosas son algo mas turbulentas. Skippers que no saben llegar a puerto, piratas y raiders que atacan empresas mediante opas hostiles, pequeños agujeros que hunden barcos, tormentas economicas, tiburones de las finanzas y, por supuesto, remoras.

La remora es un animal que se pega a otro para hacer autostop. Se aprovecha de la energia del tiburon, de las migajas de comida que le puedan caer, etc pero obviamente afecta a la velocidad y maniobrabilidad del mismo por lo que "molesta" a su huesped.

En las empresas hay remoras de todo tipo pero hoy me voy a centrar en una que en realidad no es tal: el credit manager. Por su rol, el Credit Manager maneja dos perspectivas inherentes, por un lado la necesidad de favorecer la expansión comercial y las ventas, y por otro tener en cuenta los riesgos y costes de la inversión en clientes. Ese trabajo en momentos de expansion economica lleva incluso a situaciones incomodas cuando su labor sistemática y prudente en el tratamiento del riesgo, es considerada como una remora para el departamento comercial.

Y sin embargo,.... existe otro tipo de pez que acompaña a los tiburones y ocasionalmente a los barcos, circunstancia que hizo creer a los marinos de la antigüedad que su intención era guiarlos de regreso a buen puerto, de ahí que lo bautizasen como "piloto" : El pez piloto mantiene una relación de mutualismo: ambas especies, pez piloto y tiburón, obtienen un beneficio mutuo de su asociación: el primero recibe protección y alimento a cambio de librar al segundo de los parásitos que cubren su piel (además de aprovecharse de los restos de comida de sus festines).

El credit manager, como pez piloto, libra al tiburon empresarial de los clientes-parasitos, le guia hacia caladeros de alta calidad y mantiene una relacion win-win en todo momento, porque sabe que la buena salud financiera del escualo es lo que permitira a ambos seguir navegando en las procelosas aguas de los negocios y alcanzar los ambiciosos objetivos presupuestarios .

Via https://empresologo.postach.io/post/remora-o-pez-piloto "Cuida de los pequeños gastos; un pequeño agujero hunde un barco" es una expresion atribuida a Benjamin Franklin, pero que cualquiera de nosotros en esta epoca de los pequeños gastos mensuales y las suscripciones podriamos adoptar como propia.

La frase como todas, tiene su poso de verdad. En la epoca de los grandes navios de guerra, barcos realmente grandes construidos en madera, el mayor peligro de hundimiento no era una batalla sino un pequeño gusano. El Teredo navalis en realidad es un molusco que abre galerías en la madera, devorando la celulosa que contiene... (continua)

Sabiais que en términos generales, un individuo puede aguantar 40-50 días sin comer pero solo 3-5 días sin beber. EL agua es vida!

Estoy seguro que todos conoceis las tipicas frases de "cash is king", o "be water my friend" asi que os presento una nueva: "cash is water"

Cash -al igual que el agua- es vital para la supervivencia de una empresa. La empresa necesita que la "caja" fluya (#cashflow) y -como el agua- es adaptable, no toda de igual calidad, ni igualmente accesible. Y al igual que el agua es un bien escaso (aunque muchos piensen que es sobreabundante en momentos de sobre liquidez).

Necesitamos un canal (#cashflowmanagement) que no filtre , que no tenga perdidas, que sea rapido y que permita llevar el volumen necesario para pagar CAPEX o AP (bajo control de la empresa) desde el cash que se obtiene de clientes (AR bajo control de clientes!).

Y por eso el departamento de O2C es tan importante: son quienes controlan que el agua no se pierda en exceso, que vuelva lo antes posible a circular, reducen el volumen de unos canales para poder aportar a otros (de mayor valor añadido) y se aseguran que este constantemente fluyendo.

Cash is water, porque las empresas no suelen quebrar por no ser rentable (no tener comida) mientras tenga apoyo de sus proveedores de financiacion (llámelo accionista, banco, proveedor...) y cuando lo hacen es a muy largo plazo ... no, quiebran por no tener caja! y muy rapidamente! Sin dinero para compras, sin dinero para sueldos, sin liquidez, sin agua... no hay empresa que resista.

Via https://empresologo.postach.io/post/cash-is-king-cash-is-water

Cash is King... , so improving cash flow is critical for any company (lowering liquidity risk, reducing borrowing costs,...), and the main key for cash flow is timely recovery of the account receivables.

Collecting receivables is hard even in the best of the situations (nobody wants to let go their hard earned money) and in times of crisis like today is harder: increasing DSO and delinquent days, bad debt, disputes,...you name it!

So, what can we don to improve cash flow? Streamline the back-office processes and automate as much as possible the accounts receivable team: making the customer ´experience (from order to payment, order2cash) as smooth as possible, empowering customers with digital invoicing and payment options, on-demand help, and other easy interactions that show a customer-centric approach.

Companies that just settle for old ways of managing receivables, or trust on technology that only simplifies back-office tasks without actually rethinking the process... they are putting their customer relationships at risk.... and their business too!

The root of the problem is the antiquated receivables processes that most businesses depend on. Their enterprise resource planning (ERP) systems are built to manage data, but nobody actually use the data to better serve customers.

So, what should we offer:

• Online paper-less experience, information at their fingertips or mobile ways

• Invoices should be easy and delivered as desired

• Payment method should be flexible while payment terms should be fixed (but agreed)

Make customer life easier on the payment experience and they will do more business with you and get paid

Via https://empresologo.postach.io/post/happy-customers-pay-earlier

CRM: ¿tecnología o procesos?

Mucha gente me pregunta "Tu como es que sabes de CRM si no estas en el departamento comercial?" y mi respuesta es siempre parecida : "y como sabes cocinar si no estas trabajando en un restaurante? "

Porque conocer las herramientas de la empresa es basico para cualquiera que trabaje en dicha empresa. No es necesario un conocimiento exhaustivo, pero si saber que permite y que no permite hacer. Ademas, CRM no es solo referencia a la tecnología que nos posibilita un mejor conocimiento de nuestros clientes, tambien nos referimos a él cuando hablamos de los procesos y los objetivos estratégicos orientados al cliente. Y todos los empleados de la empresa deberian saber que es lo que el cliente require y como su labor esta enfocada a resolver esa necesidad.

Por ultimo, para mi CRM no es solo Customer relationship Management, tambien podria ser Company Risk Mitigant ... al fin y al cabo solo conociendo a tus clientes puedes mitigar los riesgos asociados a realizar negocios con ellos.

La empresa ya no gira en torno al producto, sino en torno al cliente ya que realmente es él quien determina el éxito o fracaso de nuestra organización. Hemos pasado de los tiempos en los que las estrategias competitivas estaban centradas básicamente en la diferenciación del producto o en el liderazgo de costes, a centrarnos en el cliente, en saber que necesita o mejor aun que desea para colocárle en el centro de nuestra política estratégica.

Es por ello que toda empresa, y especialmente la PYME deberia evaluar la necesidad de llevar a cabo un proyecto de CRM, antes de que se convierta en una necesidad. Necesidad creada por las nuevas tecnologías, nuevos canales de interacción con el cliente y nuevos modelos de negocios.

Una vez que la organización ha decidido llevar a cabo un proyecto de CRM es importante tener claro que factores son importantes en su realización y que implica su ejecución:

Analizar la situación actual con respecto a la gestión de clientes, tanto en terminos de procesos como de tecnología. Y una vez sabemos donde estamos definir donde queremos ir y como queremos llegar:

ETAPA 1 OBJETIVOS ESTRATÉGICOS Y PROCESOS

Donde queremos llegar? como queremos trabajar con los clientes? como sabremos si estamos consiguiendo dichos objetivos (KPIs) ? y si no llegamos, a que se debe la desviacion?

El concepto de Balanced Scorecard establecido por Kaplan y Norton nos resuelve estás y otras muchas cuestiones con relación a la manera de establecer indicadores para los objetivos estratégicos (entre ellos los relativos a los clientes)

Después de tener claros los objetivos estratégicos y los indicadores adecuados referentes a los clientes, el objetivo es automatizar estos indicadores para que se pueda disponer de ellos de una manera rápida y fiable tal y como veremos en el apartado de la tecnología.

El otro aspecto que tiene que establecer la organización para realizar un proyecto de CRM es la situación actual de los procesos con relación a sus clientes. Tenemos que ver de dónde partimos para saber a dónde queremos llegar.

No se puede comenzar a informatizar unos procesos que no están claramente definidos y que no están orientados a proporcionar una adecuada información a los clientes.

En especial la empresa se debería centrar en aquellas unidades de negocio que están establecidas para dar un servicio directo al cliente, aunque por supuesto sin olvidarse de cualquier departamento soporte de las mismas, ya que proporcionar un adecuado y satisfactorio servicio al cliente no depende sólo de un departamento, sino que son muchos más los que disponen de dicha información. El objetivo es conseguir una total fluidez y transparencia en la información a través de toda la empresa. El front office que está en contacto directo con el cliente, tiene que tener toda la información referente a los clientes de una manera rápida y eficaz.

El establecimiento de los procesos utilizando las llamadas "Mejores Prácticas" es una base muy adecuada para que los procesos de la organización se optimicen. Utilizando las mejores prácticas del sector se puede conseguir una mejora sustancial en los mismos.

ETAPA 2 TECNOLOGíA

La gestión de las relaciones con los clientes de cualquier organización se puede mejorar de una manera notable en el aspecto tecnológico, tanto desde el ámbito operativo como analítico. Dentro de dichos ámbitos podríamos establecer las siguientes clasificaciones:

Ámbito Operacional:

Ámbito Analítico:

Sin embargo antes de comenzar esta etapa hay que tener en cuenta los siguientes aspectos:

ERP como base de los procesos

La base de cualquier CRM es un ERP o software de gestión empresarial. Lo primero con lo que una organización tiene que contar es con una aplicación que informatice todos sus procesos. La información que forma parte de los procesos diarios de la empresa debe de tener un soporte informático para que posteriormente pueda ser explotada. Se puede decir que el ERP es la base sobre la que nuestro CRM se implantará, ya que, por ejemplo, sería mucho más complejo decir a nuestro cliente en que situación se encuentra su pedido si esta consulta no la podemos realizar a través del sistema informático.

La elección de un ERP por parte de la organización es una de las claves para que la estrategia CRM tenga éxito. Esta elección dependerá entre otros aspectos de la cantidad de transacciones de la empresa y de la complejidad de sus procesos. Además la organización deberá de valorar qué módulos son los que necesita implantar teniendo en cuenta sus procesos.

Una vez que la empresa ha seleccionado el ERP adecuado y evaluado los módulos que necesita, pasará a la fase de implantación y una de las claves para garantizar que ésta sea eficiente y eficaz es la utilización de una adecuada metodología.

Perspectiva de interacción con el Cliente.

Hoy en día los clientes interaccionan con la empresa por medio de distintos canales, y deben de poder obtener la misma información por cualquiera de ellos. Podemos citar como los tres principales canales:

El cliente espera que la empresa le proporcione un servicio eficaz, rápido y seguro por cualquiera de los tres medios.

En los últimos meses la estrategia web de la empresa ha cobrado una gran importancia. Con la personalización de la website al perfil de cada cliente ó usuario, la organización puede conseguir una mayor fidelidad de los clientes que cada vez más buscan un servicio 24x7x365. Los clientes demandan poder recibir la misma información por medio de la website que por el call center de la empresa. Por ello querrán saber por ejemplo, en qué estado está su pedido por cualquiera de los canales de la empresa.

Con la integración de todos los canales de la empresa, ofreciendo al cliente una información homogénea por medio de los mismos, conseguiremos que a nivel corporativo exista una estrategia de orientación completa al cliente.

Gran parte de la información que estas herramientas proporcionen se va a tener que basar en el ERP de la organización, por lo debe de existir una adecuada integración entre éstas y el ERP.

perspectiva de marketing

Uno de los departamentos que necesariamente obtendrá grandes mejoras y beneficios con un CRM es el departamento de marketing. ¿Qué puede aportarle el CRM a este departamento?. Aquí podemos clasificar las utilidades en dos tipos:

Analíticas: se podrán realizar análisis de los distintos segmentos de clientes, de las preferencias de los mismos, por lo que el departamento de marketing además de conocer con profundidad a los distintos clientes podrá orientar sus campañas de marketing de una manera más eficaz. En este tipo de utilidades profundizaremos más en el apartado correspondiente al ámbito analítico

Operativas: permitirán realizar fácilmente marketing one to one, campañas personalizadas utilizando herramientas especializadas para las mismas. Entre las ventajas más importantes que se pueden obtener utilizando este tipo de campañas, merece la pena citar:

Uno de los puntos más importantes para conocer a nuestros clientes es poder analizar y profundizar en la información que tenemos sobre ellos. ¿De que sirve la información sino podemos analizarla y sacar conclusiones de la misma? Basándose en dicho análisis y en la simulación de determinadas situaciones, se puede establecer la estrategia de gestión de nuestros clientes.

Con relación a las herramientas existentes para este ámbito, estableceremos una diferenciación en tres tipos distintos de sistemas:

Los sistemas de Business Intelligence nos proporcionan los medios para poder integrar y analizar la información. Incluyen capacidades de análisis multidimensional, que permiten navegar y profundizar a través de los datos, agregando y desagregando "on line" por las dimensiones que consideremos más importantes y permitiendo la definición y seguimiento de los indicadores de negocio más relevantes de la compañía.

Integrar la información de los diferentes sistemas operacionales y de fuentes de información externa, poder analizarla y profundizar en ella proporcionando además un sistema de reporting a la organización, se puede conseguir con un sistema de Data Warehouse y herramientas OLAP. De este modo se podrá responder a preguntas cómo ¿quiénes son los clientes más rentable? ¿cuáles son los clientes que han respondido mejor ante una campaña de marketing?.... Se pueden obtener una serie de informes e indicadores de forma automatizada que nos respondan a estas y ha otras muchas preguntas. Es decir de este modo conseguiremos la automatización del concepto de Balanced Scorecard analizado en el primer apartado y correspondiente a los procesos y los objetivos estratégicos e indicadores de la organización.

Sin embargo, hoy en día no basta con el análisis de la información que la empresa posee de los clientes que han interactuado con la organización por los canales tradicionales. La irrupción de Internet en el mundo y la extensión de su uso, han hecho que el análisis de la efectividad de la estrategia web de la empresa sea de vital importancia. El simple hecho de tener una página web no garantiza ni mucho menos el éxito de la misma, sino que incluso puede llegar a producir el efecto contrario. Por ello las herramientas de web mining que analizan los archivos log de los sitios web de las organizaciones, proporcionan una información muy útil y necesaria en la gestión de dichas páginas. Las acciones de los visitantes de la página web son registradas en un fichero log permitiendo que tras realizar el análisis de los mismos podamos responder a preguntas cómo si los clientes repiten visita, cuáles son los productos más seleccionados, perfil de nuestros visitantes (en caso que nos proporciones sus datos), etc. En definitiva conocer más a nuestros clientes y saber si nuestra estrategia web es efectiva.

Otro punto importante es la simulación: poder realizar un análisis de lo que sucedería en los distintos escenarios. Por ejemplo podríamos ver cómo pueden aumentar en mayor ó menor medida las ventas con el hecho de que se lleve a cabo una determinada campaña de marketing u otra.

Por lo tanto, el objetivo es analizar la información, realizar simulaciones de determinados hechos sobre la base de lo que hemos obtenido con el análisis, y por último ejecutar la acción más adecuada sobre la base de la información que hemos obtenido. En este punto volveríamos otra vez al comienzo de nuevo, analizando los resultados obtenidos de la ejecución de nuestras acciones

ETAPA 3: GESTIÓN DEL CAMBIO

Vamos a hablar por fin de la tercera etapa sin que esto signifique que sea la última, ya que esta fase debe de realizarse al mismo tiempo que se realizan las anteriores. Una de las claves para el buen resultado del establecimiento del CRM son las personas. La gestión del cambio cultural que puede significar un proyecto de este tipo es la clave para que éste se realice de una manera adecuada, ya que una gran parte del éxito del mismo depende de dicha gestión. No hay que olvidar que a fin de cuentas las personas son el cimiento de la organización y que a lo largo de la historia el no realizan una buena gestión de los Recursos Humanos ha producido fracasos en los proyectos.

Hay varios aspectos importantes en los que hay que incidir respecto a esta gestión del cambio. La motivación de las personas es uno de ellos, se necesita que los empleados estén favorablemente predispuestos al cambio, para ello es esencial que exista una buena política de información en la empresa. Nadie quiere cambiar si no piensa que el cambio va a ser favorable y que va a salir ganando con él. Por ello es importante que la idea de que un proyecto CRM favorece al empleado en la medida en que también favorece a los clientes y por lo tanto a la empresa. Pero además el trabajador tiene que saber que está adecuadamente preparado para este cambio para que no tenga la percepción de que el cambio sobrepasa sus posibilidades, por ello la información y formación en los nuevos procesos, objetivos estratégicos y herramientas tecnológicas es fundamental para el éxito del proyecto.

Realmente el éxito o fracaso de cualquier organización depende del capital humano.

Tags: published, business, financial, management April 30, 2019 at 11:43AM Open in Evernote

Performance Measures for Credit, Collections and Accounts Receivable

Performance Measures for Credit, Collections and Accounts ReceivableCRF thanks Rob Olsen, CCE for his work on this section If there is one thing that credit executives agree upon, it is that they cannot agree on which measures to use in evaluating individual, departmental, and company performance. In researching the myriad measures available, it is evident that choosing an individual or group of measures is a personal, company, or industry preference. Since many organizations cannot agree among themselves on which measures to use, the person with the most authority usually dictates the measures to be reported to management. Even though credit, collections, and accounts receivable personnel report the requested data to management, most individually track other measures to "see how they are really doing." This section is not attempting to dictate, or even suggest, which performance measures are most valid and should be used. The purpose of this section is to serve as a reference guide to readers and provide them with a comprehensive collection of performance measures used in credit, collections, and accounts receivable, hence, allowing the individual to make educated decisions on what to use and why. Dynamic credit executives plan and direct the credit, collection, and accounts receivable functions to increase sales and profits. While pursuing these goals, they use their decision-making capabilities to foster growth, optimize cash inflows, and improve the quality of work performed by credit, collections, and accounts receivable personnel. Using valid measures of performance is critical in this process. For many years credit and finance professionals, along with academic researchers, have been seeking a means of accurately measuring performance in credit, collections, and accounts receivable. Most of the measures that are currently in use have value. Unfortunately, they also have flaws. The challenge is to understand the individual measures and use them appropriately. The prudent credit professional will have a clear understanding of the importance of spending the necessary time and effort to understand the individual measures of performance and implement the appropriate measures to meet the needs of their organization. Using Appropriate Measures of Performance Can Help:

Regardless of the measures chosen to evaluate an organization, they must be able to stand the test of time. The measures that make an organization look good today may not in the future. The goal is to identify and consistently use valid measures that work over time, not just measures that work for the moment. If a measure is not understood it should not be used. It is difficult to explain or defend something that is not understood. Always use measures that accurately reflect reality, and then manage for improvement. What Makes A Measure Meaningful? The measure used must have a standard. The standard can be a set value or a range. For example, if the controller of a company is using Days Sales Outstanding (DSO) as an overall measure of accounts receivable in relationship to credit sales, what is acceptable? Is the standard a set value such as 45 days, where any value below 45 days is acceptable? Perhaps the standard is a range such as 42 days to 51 days, where any value within the range is acceptable. Using a range as a standard has some benefits. In this example, the low-end of the range may reflect a credit policy that is too strict, while the high end may indicate a policy that is too liberal. If a company does not sell to marginal customers, the company's DSO will be lower than if they accept the increased risk and potential profit associated with marginal customers. A measure must be compared to some standard or it has no meaning. Standards may be set according to past organizational or industry values or trends. Again, using the DSO example, the acceptable range may be the industry high and low from a standard determined externally, such as those published by the Credit Research Foundation in its quarterly publication, The National Summary of Domestic Trade Receivables or Robert Morris Associates' Annual Statement Studies. Choosing a range for a standard can provide the tolerance that is sometimes needed to allow for situations such as seasonal sales. Consistency is the next element of a meaningful measure. If the standard DSO calculation is used one month, Sales Weighted DSO cannot be used the following month. Likewise, the acceptable standard and the comparable standard cannot change monthly. It's true that measures need to be evaluated and updated from time to time, but the update should be completed on more of an annual basis than monthly. The effective implementation of measures requires action. This is similar to a guidance system on a missile. It has an acceptable standard (hitting the target). It also has a comparative standard (the course to the target). The missile is constantly comparing its current position (course) to its destination (target) and making the necessary corrections to stay on course. As mentioned earlier, the acceptable standard can be specific or general. An effective measure provides a benefit. One benefit could be the satisfaction of reaching a goal and realizing the implications of that success. The question could be asked, "If a measure provides no benefit, why bother using it?" Organizations should communicate all measures and standards to those individuals who are responsible for executing the action plan that will help the organization reach its goals. Measures of performance should be graphed or charted as part of the reporting process. The old adage that states, "when performance is measured, performance improves, but when performance is measured and reported, the rate of performance accelerates" is true. What Is The "Right" Measure? The following questions will help you determine if the right measure is being used:

TIP Formulas such as DSO that use periods of time, can be very erratic over the course of a year if the business is affected by seasonal sales influences or long dating terms. A suggestion would be to change the formula to use a year's worth of data. For instance use a rolling 12 months so that the impact of the sales peaks and valleys is somewhat neutralized. Credit and Collection Measures Collection Effectiveness Index (CEI) Definition: This percentage expresses the effectiveness of collection efforts over time. The closer to 100 percent, the more effective the collection effort. It is a measure of the quality of collection of receivables, not of time.Formula:

Formula: Ending Total Receivables x Number of Days in Period AnalyzedCredit Sales for Period Analyzed Best Possible Days Sales Outstanding or Average Terms Based on Customer Payment Patterns Definition: This figure expresses the best possible level of receivables.

Formula: Current Receivables x Number of Days in Period AnalyzedCredit Sales for Period Analyzed Sales Weighted DSO Definition: This figure expresses the (aggregate) average time, in days, that receivables are outstanding. Formula:

((Current Age Category / Credit Sales of Current Period) + (1 to 30 Day Age Category / Credit Sales of Prior Period)+(31 to 60 Day Age Category / Credit Sales of 2nd Prior Period) + (61 to 90 Day Age Category / Credit Sales of 3rd Prior Period) + (91 to 120 Day Age Category / Credit Sales of 4th Prior Period) + (etc.)) x 30

Note: There are several formulas to calculate Sales Weighted DSO. This is a simple expression of those formulas. Other formulas or expressions yield the same results. True DSO Definition: The accurate and actual number of days credit sales are unpaid.Formula:

Number of days from invoice date to reporting date x (invoice amount/net credit sales for the month in which the sale occurred) = True DSO per invoice.

Delinquent DSO or Average Days Delinquent Definition: This figure expresses, in days, the average time from the invoice due date to the paid date, or the average days invoices are past due.

The sum of True DSO for all open invoices = True DSO per total accounts receivable. Formula:

DSO minus Average Terms Based on Customer Payment Patterns (Best Possible DSO)

Days Average Collection Rate Definition: This figure expresses, in days, the average time from the invoice date to the date paid.

Formula: Total Flow of FundsTotal Funds Applied Prior Month's Past Due Collected Definition: This percentage expresses the amount that has been collected in the current month of the prior month's past due amount. Formula:

Formula: Sum of the 61 Days and Older CategoriesTotal Receivables Bad Debt to Sales Definition: This expresses the percentage of credit sales that were written off to bad debt. A lower percentage signifies that effective credit policies and procedures are employed. Formula: Bad Debt Net of RecoveriesCredit Sales Active Customer Accounts per Credit and Collection Employee (Total Department) Definition: This figure represents the total number of active accounts per department employee. Generally, the higher the number of accounts per employee, the more efficient the use of technology and people. (This is a departmental measure.) Formula: Number of Active Customer AccountsNumber of Total Department Employees Active Customer Accounts per Credit Representative or Collector Definition: This figure represents the total number of active accounts for an individual credit representative or collector. Generally the higher the number of accounts per employee, the more efficient the use of technology and people. (This is an individual measure.) Formula: Number of Active Customer AccountsNumber of Total Credit Representatives or Collectors Operating Cost per Employee Definition: This figure represents the total dollars spent per employee. The lower the cost, the more effective use of technology and people.

Formula: Departmental Operating CostsNumber of Department Employees Cost per Sales Dollar Definition: This calculation relates dollars spent in the credit and collection effort to credit sales generated, or how much it cost the company to process each dollar in credit sales. A higher percentage signifies that a more effective operation is employed: Formula: Departmental Operating CostsCredit Sales Is your cost per credit sales dollar good? This question is relative. It could be answered by benchmarking with other organizations or measuring itself against its own past performance. Cost of Collections Definition: This percentage represents the cost of collecting the collectable amount of Bad Debt. The lower the percentage, the more effective the attorney(s) or agency(s) employed.Formula: Amount Paid to Attornies and AgenciesCollected Amount High-Funds Accounts Definition: This measure identifies accounts where significant funds could be collected in a relative short time. You must set the criteria for your business. Example: by identifying accounts that have at least $2,000 over 60 Days and a total due of $5,000 or more that are not paying according to terms because of improper billing or processing problems. The closer to zero the more effective the collection effort, the better the working relationship with the customer and the more credit, collections, and accounts receivable policies and procedures are being followed. Formula: The Number of High-Funds Generating AccountsHigh-Risk Accounts Definition: This measure identifies significant potential bad debt accounts so they can be collected, thereby maximizing profits by minimizing losses. You must set the criteria for your business. Example: these accounts have at least $2,000 over 60 Days and a total due of $5,000 and the customer is not paying because of its lack of ability to pay or some unknown reason for not paying according to terms. The closer to zero the more effective the collection effort, the better the working relationship with the customer and the more credit, collections, and accounts receivable policies and procedures are being followed. Formula: Number of High-Risk AccountsAccounts Receivable Measures Check Turnover per Cash Applicator Definition: This figure indicates the number of checks processed per person responsible for actually applying checks. A higher turnover rate implies that an efficient system is employed.This measure could include automated remittance processing "auto-cash". (Whether automated processing is included or not is a matter of choice, or in benchmarking comparability, sense consistency is the key.) Once the parameters are set, they should not change in like comparisons. Formula: Number of Checks ProcessedNumber of Cash Applicators Transaction Turnover per Cash Applicator Definition: This figure indicates the number of transactions processed per cash applicator. A transaction includes all invoices, credits, deductions, and payments. A higher turnover rate implies that a more efficient system is employed. This measure could include automated remittance processing "auto-cash". (Whether automated processing is included or not is a matter of choice, or in benchmarking comparability, sense consistency is the key.) Once the parameters are set, they should not change in like comparisons. Formula: Number of Transactions ProcessedNumber of Cash Applicators Transaction Turnover per Accounts Receivable Employee Definition: This figure indicates the number of transactions processed per individual employee. All employees involved in accounts receivable are included because their combined duties are directed in some fashion to processing transactions of all types. This includes secretaries, administrators, supervisors, and managers. A transaction includes all invoices, credits, deductions, and payments. A higher turnover rate implies that a more efficient system is employed. This measure could include automated remittance processing "auto-cash". (Whether automated processing is included or not is a matter of choice, or in benchmarking comparability, sense consistency is the key.) Once the parameters are set, they should not change in like comparisons. Formula: Number of Transactions ProcessedNumber of Accounts Receivable Employees Deduction Turnover per Cash Applicator and A/R Deduction Specialist Definition: This figure indicates the total number of deductions processed by cash application and deduction specialists. The higher the turnover, the greater the efficiency per employee. (However, the lower the number of deductions, the more efficient the organization's billing process.) Formula: Deductions ProcessedCash Applicators & Deductions Specialist Operating Cost per Transaction Definition: This figure indicates the cost of an individual transaction. The lower cost per transaction implies a more efficient use of technology and people. Formula: Departmental Operating CostsNumber of Transactions Processed Copyright 1999 Credit Research Foundation

Measure

Measure

Tags: published, management, risk June 02, 2019 at 08:25PM Open in Evernote

Business Risk Decission

It is important that the professional lender remains objective, avoiding the temptation to become emotionally commited to other than providing a service. The borrower may well have been planning the project over a long period and expects an inmediate answer... however, the lender must take the time necessary to reach a lending decission, it is not in the interest of either party to get it wrong...

The decision must been taken following certain principles and structure:

Tags: IFTTT, blog, published, web January 27, 2015 at 04:43PM Open in Evernote

5 calculations no Credit Manager should do by hand

A credit manager wants to achieve maximum results – visible through measurements and metrics. Daily measurements showing the financial health of your receivables portfolio and how your team is performing against their targets are essential in order to stay on track.

However, most of them mean collecting information from various systems topped up by hours of Excel building. That´s why a good system or credit software might be of handy.

1. DSO - Days Sales Outstanding. It’s a measure of the average number of days your team takes to collect revenue after an invoice has been sent. A relatively high DSO typically indicates that an organisation has a customer portfolio with credit challenges or a collections team that is underperforming. A low DSO can come from a high performing team, but also be a signal that credit policies are too tight which could impact an organisation’s competitive position in the longer run. There are several ways of calculating DSO, but in general it tells you:

2. Ageing Invoice, how long the invoice ages (like wine ages, but in this case it turns in vinager) before the customer pays an invoice. The ageing should be as low as possible of course. The oldest invoices (and largest) are the biggest worry for a credit manager. Not only for it will become more and more difficult to recover but also for how much money (interest, margin,..have you already missed on these unpaid invoices).

3. Historical payment period The historical payment period shows an average over the whole of last year. So the more invoices the customer has paid, the more accurate this number becomes since it’s a weighted average.

4. Customer Score. Based on data which comes from payment behaviour, from external systems or even third party data sources. An example is a sudden change in a customer’s payment behaviour which could be an early warning signal of bigger problems. Taking proactive action can help prevent bigger issues in the future.

5. Interest and Cost - Both for internal reference (what is this open invoice actually costing me?) and external reference (dear customer, please be informed that this is what this open invoice is costing me) it’s a great calculation.

Tags: IT, published, Accounting, business, risk October 19, 2015 at 12:37PM Open in Evernote |

AuthorLicenciado en Empresariales soy por lo tanto un empresologo...y he trabajado como morosologo, analista,... Archives

March 2022

Categories |

||||||||||||||||||||||||||

| Alejo Lopez Casao |

|

RSS Feed

RSS Feed